If you have a chronic health condition and regularly see consultants, you’ll know that payment for these appointments often requires a visit to the bank or writing out a cheque. However, there are now a number of ways to pay consultation fees online using Stripe – an easy-to-use payment processing system. In this blog post, we’ll look at how to use Stripe to pay for consultations, as well as giving some tips on how to get the most out of this service.

Key Points:

- You can pay for telemedicine consultations in a few different ways, the most common being online payments.

- To make an online payment, you will need to provide your credit card information to the payment processor (Stripe).

- Online payments are safe if you take some precautions such as making sure the site is using SSL and is PCI Compliant.

- You can use Apple Pay or Google Pay as digital wallets for online payments.

How does online payment work?

Online payments allow customers to make purchases or pay bills without having to carry cash or write a check. When you make an online payment, the funds are transferred from your bank account to the merchant’s account.

Card processing is the most common type of online payment. When you use a credit or debit card to make an online purchase, the card information is transmitted to the merchant through a secure network. The merchant then submits the transaction to their bank for approval. Once the transaction is approved, the funds are transferred from your account to the merchant’s account.

Another popular type of online payment is through a digital wallet. With a digital wallet, you can store your credit and debit card information in one place. When you make a purchase, the funds are transferred from your digital wallet to the merchant’s account.

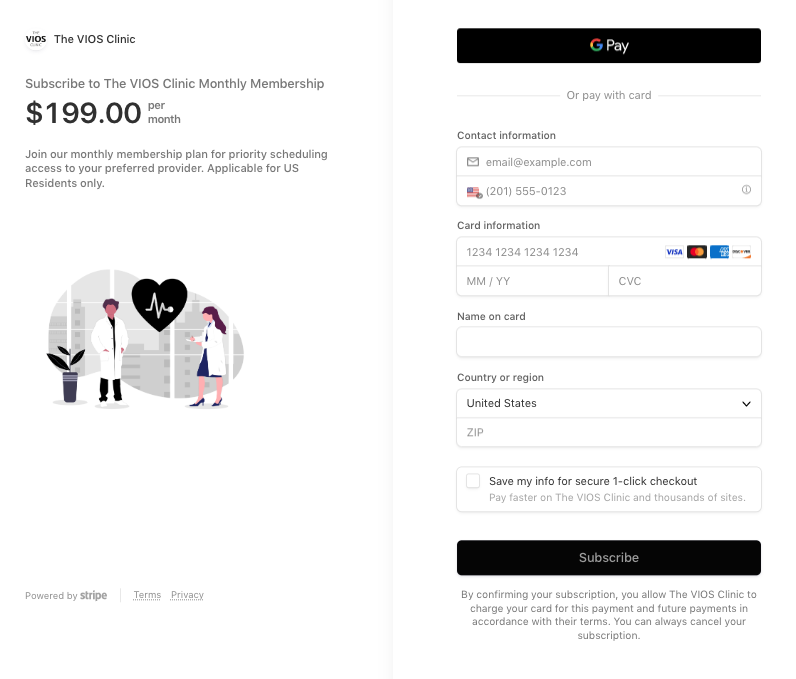

When you schedule a telemedicine consultation with a doctor or other healthcare provider, you will be asked to provide your credit card information in order to pay the consultation fee. The consultation fee will be processed using a service called Stripe.

Stripe is a secure, online credit card processing service that allows businesses to accept payments over the internet. When you provide your credit card information to Stripe, it will be encrypted and stored in a secure database. Stripe will then charge your card for the amount of the consultation fee.

Are online payments safe?

When it comes to online payments, there are a few things to keep in mind in order to ensure safety. One of the most important is to make sure that the site you are making your payment on is using SSL (Secure Sockets Layer). This is a protocol that helps to encrypt sensitive information like credit card numbers so that it cannot be intercepted by third parties.

In addition, the site should also be PCI Compliant (Payment Card Industry Data Security Standard). This means that it adheres to a set of standards designed to protect customer data.

Finally, it is also a good idea to use a 2-Factor authentication method whenever possible. This adds an extra layer of security by requiring you to enter a code that is sent to your mobile device in addition to your password. By following these simple tips, you can help to ensure that your online payments are safe and secure.

Which credit cards are accepted for online payments?

There are a number of different credit cards that can be used for online payments. Visa, MasterCard, and American Express are all widely accepted. Each of these credit cards has its own advantages and disadvantages, so it’s important to choose the one that’s right for you.

VISA

Visa is one of the most popular credit cards for online payments. It’s accepted by a wide range of merchants, and it offers a variety of features and benefits. However, Visa also charges a foreign transaction fee, so it’s not the best choice if you’re making purchases in another currency.

MasterCard

MasterCard is another popular option for online payments. It doesn’t charge a foreign transaction fee, so it can be a good choice for international transactions. MasterCard also offers a variety of features and benefits, but it’s not as widely accepted as Visa.

American Express

American Express is a less popular choice for online payments, but it has some advantages over the other two options. American Express doesn’t charge a foreign transaction fee, and it offers a variety of rewards and perks. However, American Express isn’t accepted by as many merchants as Visa or MasterCard.

Can I use Apple Pay or Google Pay?

Digital wallets are becoming increasingly popular for online payments. Apple Pay and Google Pay are two of the most popular digital wallets available. Both Apple Pay and Google Pay are accepted by a growing number of online retailers and can be used for a variety of online payments. Apple Pay is also accepted by a growing number of brick-and-mortar stores. Google Pay can be used for in-app purchases and online payments.

Digital wallets offer a convenient way to pay for goods and services online. Apple Pay and Google Pay are two of the most popular digital wallets available.

When paying with either Apple Pay or Google Pay, your financial information is not shared with the merchant. Instead, a unique token is used to process the payment. This helps to keep your financial information safe and secure. Apple Pay and Google Pay are both convenient and secure ways to pay for goods and services online.

Are online payments ideal for Cash-Pay memberships?

Memberships can be a great way to access exclusive content or services, but they also require regular payments. For many people, setting up automatic payments is the best way to ensure that their membership dues are paid on time.

There are a few things to consider when setting up online payments for memberships. First, you’ll need to choose a payment processor. There are a number of options available, so it’s important to do some research to find one that best meets your needs. Once you’ve selected a payment processor, you’ll need to set up an account and provide your membership information.

Once your account is set up, you’ll need to decide how you want to be billed. Most membership dues are paid on a monthly basis, but some companies offer discounts for quarterly or annual payments. You’ll also need to provide your payment information, such as your credit card number or bank account information.

Once everything is set up, your membership dues will be automatically deducted from your account each month. This can be a great way to ensure that you never miss a payment and lose access to your content or services. However, it’s important to make sure that you have the funds available in your account to cover the charges. If you don’t, you may be subject to late fees or other penalties.

Can online payments be done on Sundays?

Yes, online payments can be done on Sundays. Many online payment platforms are available 24/7, so you can make a payment anytime. However, some banks may not process online payments on Sundays, so it’s best to check with your bank before making a payment.

Can I do online payments without a bank account?

Yes, online payments can be made without a bank account. There are a number of payment processors that allow you to make online payments without a bank account. These processors typically use a credit or debit card as the source of funds for the payment. Some of these processors also offer prepaid cards that can be used to make online payments.

Why is there a delay in processing online payments?

There can be a number of reasons for delays in online payments. First, the payment may need to be verified by the bank or credit card company. This process can take a few days. Second, the online retailer may have a policy of not shipping orders until payment has been received. This can cause a delay of a few days. Finally, there may be a problem with the online payment system itself. This can cause delays of several days.

Why do some online payments fail?

There can be several reasons why online payments may fail. The most common reason is that the billing information entered does not match the information on file with the credit card issuer. This can be due to an error when inputting the information, or because the credit card issuer has outdated information on file.

Another common reason for online payment failures is that the credit card being used has insufficient funds available. This can happen if the cardholder has recently made a large purchase or if there are outstanding charges on the card.

Finally, online payments can also fail if there are issues with the payment processor itself. This is usually beyond the control of the cardholder or merchant and will require contacting the payment processor for assistance.

If you are experiencing issues with online payments, it is best to contact your credit card issuer or payment processor for assistance.

Can online payments be reversed? Can I dispute a transaction?

Yes, online payments can be reversed. If you have made a payment online and would like to dispute the transaction, you can contact your bank or credit card company to initiate a chargeback.

How to pay for Telemedicine consultations?

There are a few different ways that you can pay for telemedicine consultations. The most common way is to use online payments. You can also set up a monthly membership, which will allow you to have unlimited access to telemedicine services. Another option is to pay per consultation. Here are a few different ways to pay for telemedicine consultations:

Online Payments

One of the most common ways to pay for telemedicine consultations is through online payments. You can use a credit or debit card to pay for your consultation. This is a convenient way to pay, as you can do it from the comfort of your own home. You will need to provide your billing information when you book your consultation.

Monthly Memberships

Another way to pay for telemedicine consultations is through monthly memberships. This option is ideal if you plan on using telemedicine services on a regular basis. With a monthly membership, you will have unlimited access to telemedicine services. You will be billed monthly for your membership.

Pay per Consultation

If you only need to use telemedicine services occasionally, you can pay per consultation. This option allows you to pay for only the consultations that you need. You can pay for your consultation online or over the phone.

How to pay online for telemedicine consults using Stripe

There are a few different ways that you can pay for your monthly membership or online consultation fees. The most common way is through a service called Stripe.

Stripe is a company that allows businesses to accept payments online. They are one of the most popular payment processors and are used by many telemedicine companies.

To set up Stripe, you will need to create an account and then link it to your telemedicine platform. Once you have done this, you will be able to accept payments from patients easily and securely.

Another way to pay for telemedicine consultations is through a monthly membership. This is a good option if you plan on using the service frequently. Most telemedicine platforms offer monthly memberships that include a certain number of free minutes or consultations.

You can also pay for individual consultations as needed. This is a good option if you only need to use the service occasionally. Many telemedicine platforms charge per minute, so you will only be charged for the time you use the service.

Can I manage my monthly memberships online?

Yes, you can easily manage your monthly memberships online. We accept payments via Stripe, and you can update your payment information at any time. To pay for a consultation, simply log in to your account through the Patient Portal and click on the “Billing” tab.

From there, you will be able to enter your payment information, change your subscriptions and complete the transaction. If you have any questions about our billing process, please contact our customer support team at [email protected].

Conclusion

If you’re looking for a convenient and affordable way to pay your consultant fees, Stripe is the perfect solution. Our monthly membership plans make it easy to cover all of your appointments without breaking the bank. Sign up today and see the difference payment processing can make for your chronic health condition management.

BLOG AUTHOR

Dr. Ismail Sayeed

Dr. Sayeed is the Medical Director of ViOS, Inc. He is a deeply committed physician entrepreneur & medical blog writer. While building the global infrastructure of the VIOS Clinic, he is dedicated to educate people on the potential of specialist telemedicine for managing chronic diseases.

Read more about him in his author bio